by Kathy Lloyd

Employment Tax Director

12 March 2025

Articleby Kathy Lloyd

Employment Tax Director

A change has been made to the treatment of double cab pickups (DCPUs) that could affect many employees and employers for income tax and Class 1A NIC purposes. DCPUs have previously been treated as vans for benefit in kind purposes.

The change to the treatment as cars was confirmed by Rachel Reeves in the 2024 Autumn statement, therefore from 6 April 2025 the Government will treat DCPUs with a payload of one tonne or more as cars, for income tax and Class 1A NIC.

Transitional benefit in kind arrangements will apply for employers that have purchased, leased, or ordered a DCPU before 6 April 2025. They will be able to use the previous treatment, until the earliest of disposal, lease expiry, or 5 April 2029, at which point the benefit in kind income tax and Class 1A NICs will increase significantly.

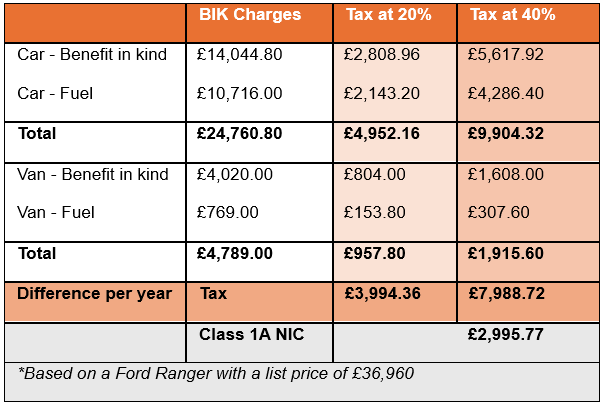

Company vans are taxed on a fixed benefit in kind value of £4,020 and with private fuel an additional £769 will apply.

Company cars are taxed based on the list price and a percentage which is based on the fuel and the CO2 emissions of the car.

Fuel for private use in a company car is based on the same company car percentage multiplied by £28,200.

The benefit in kind charge applies where there is private use of a vehicle. Cars which are available for private use (separate to pool cars) are always subject to the benefit in kind charge.

The rules regarding private use for vans are more flexible, as vans can be kept at an employee’s home overnight and limited incidental private use is permitted. The benefit in kind is taxable on the employee, however employers must pay Class 1A NIC at 15% (from April 2025) on the benefit.

The table below compares the benefit in kind (‘BIK’) charges on a van and a typical DCPU under the new car rules (based on a Ford Ranger). The difference per year in tax is nearly £8,000 for a 40% taxpayer, while the employer will have to pay an additional NIC liability of nearly £3,000.

DCPUs will also be treated as cars for capital allowances and for some deductions from business profits, with similar transitional arrangements.

Key take-aways for employers:

How can we help?

At James Cowper Kreston, our employment tax specialists can guide clients (and their employees) through the detail of the new legislation, using their deep technical and practical experience with employment tax compliance.

Contact our Employment Tax team, or your usual contact at James Cowper Kreston today, to discuss these changes so that we can help you maximise your business potential.