by Margaret Savory

Tax Consultant

8 January 2024

Newsletters and Updatesby Margaret Savory

Tax Consultant

At the end of 2023, the government published draft legislation with details of the new regime for R&D tax relief, “the merged scheme” which will replace the existing SME and R&D Expenditure Credit (“RDEC”) schemes for accounting periods commencing on or after 1 April 2024.

It also introduces various other changes, some of them previously announced and some in the Autumn Statement.

It is vitally important that all companies claiming R&D tax relief are aware of the proposed changes and plan accordingly, as all claimants are likely to be affected. There are, however, questions and uncertainties arising from the current draft legislation, especially as companies transition to the new rules.

Note that this is currently draft legislation and subject to amendment. There is also a Spring Budget on 6 March 2024 and a General Election within the next year, so there could be further changes.

Key features of the new merged scheme

The merged scheme is modelled on the existing RDEC scheme. It is an “Above the line” taxable receipt, with a payment to the company after all other tax liabilities have been settled.

The current rate is a taxable 20%. For profit making companies the tax deducted will be at their effective tax rate (varying between 25% and 19%). Loss making companies will receive a refund net of the small companies’ rate (currently 19%). In practice, this means the merged scheme net credit will be between £1,500 and £1,620 for every £10,000 of qualifying expenditure.

There continues to be a PAYE/NIC linked cap on the credit refunded, but this follows the more generous rules for the current SME scheme PAYE/NIC cap, i.e. refunds will be restricted to 3 x total PAYE/NIC costs plus £20,000. The current exemption to the cap remains if certain qualifying conditions are met.

Complexities around subcontractors

HMRC consulted widely on who should receive the relief when there is a chain of subcontractors all solving the same scientific or technological issue. The draft legislation gives the tax relief to the person who requires the R&D to be undertaken (i.e. the “customer”). It lists out the following specific requirements:

In addition to the contract itself, evidence of the nature of the relationship may be provided by the “surrounding circumstances” i.e. was R&D contemplated at the time the contract was entered into? The Explanatory Note to the draft legislation states, “If contractors are unsure, they should clarify as part of the negotiation process” and adds “it is the position at the time that the contract was entered into which is key.”

For the company undertaking the R&D activity on behalf of the customer, effectively there will be no R&D tax relief for their expenditure. The only exceptions are if their customer company is an “ineligible” one, (such as charities, higher education institutions, or various health or science research institutions) or one not within the UK tax net.

Companies in the same (group relief) group, where one subcontracts work to the other may make a joint election to enable the subcontractor to claim.

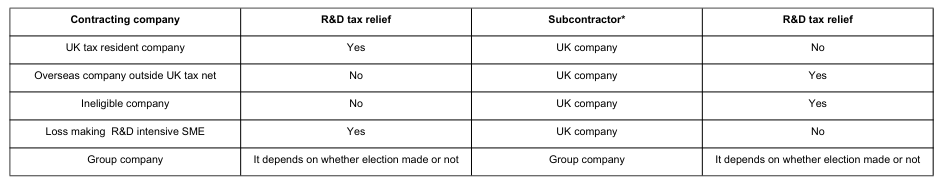

The table below summarises the proposed position in broad terms:

For accounting periods beginning from 1 April 2024 - Who can claim relief?

*Assumes all R&D activities are performed in the UK

This is clearly going to be an area that will be fraught with complexities. Companies will need to review existing contracts as well as factor the new rules into their contractual negotiations to establish where the eligibility for R&D tax relief lies.

Externally Provided Workers

The amount of relief claimable will now be restricted to ensure that the workers so provided are paying sufficient UK PAYE/NIC. Therefore, a company claiming R&D tax relief for Externally Provided Workers will need to ensure that the staff controller is paying sufficient salary to the workers to cover whatever the company is including in the R&D tax relief claim.

Overseas outsourced R&D activities

The restriction to UK-only activities, with just a few limited exceptions, was previously announced and will come into force for accounting periods beginning on or after 1 April 2024.

Loss-making R&D intensive SMEs will continue with a separate scheme

These companies are defined as an SME whose relevant R&D expenditure for the period is at least 30% of the total expenditure for the period (40% for 2023). A grace period of one year is included if the company temporarily dips below the threshold. Such companies will generally operate under the merged scheme, except the calculation of relief will follow existing methodology, with an 86% uplift to qualifying costs with a surrender value of 14.5%. This gives rise to a refund of up to £2,697 for every £10,000 of qualifying expenditure.

Not included in the draft legislation

Administration continues as before with a little bit of tightening up

Already in place are the requirements to:

No change to the definition of R&D for tax purposes

Whilst the proposed changes in the draft legislation are wide reaching and will affect most companies, the definition of R&D for these purposes has not changed. The source continues to be the DSIT Guidelines on the Meaning of R&D for Tax Purposes. This defines R&D for tax purposes as one where a project seeks to achieve an advance in science or technology through the resolution of scientific or technological uncertainty. Click here for further information.

Winners and losers

The new legislation means that some companies will now be able to claim costs where previously they have not been able to, for example a company under the RDEC scheme where it previously subcontracted an element of R&D to another company.

However, there are also losers, e.g. many companies who choose to use overseas R&D subcontractors.

Companies making R&D tax relief claims should be planning now for all the proposed changes

Amongst other things you should:

If you would like to discuss any aspect of your R&D tax relief claims, now or in the future, please contact our R&D tax relief team here.